Bill of Exchange and Cheque are the most common documents which are used widely by all most every person to make payments easily. Both these documents have much Difference Between Cheque and Bill of Exchange and similarities which contribute to their uniqueness in terms of functionality. We have also written an article about the Difference between Promissory Note and Bill of Exchange.

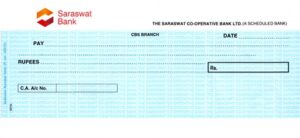

CHEQUE

A Cheque generally is an order by the customer of a bank directing the bank to pay on demand, the specified amount to the bearer of the cheque or for the person which the cheque is issued. A Cheque is a usual method of withdrawing money from a current account of the customer with the bank. Savings accounts are also permitted to use cheques by maintaining a certain amount of balance in the account.

PARTIES OF CHEQUE

⦿ Drawer – the drawer is the person who writes or issues the check

⦿Payee – the payee is the person to whom the order the check is made out

⦿ Drawee – the drawee is the bank with which the drawer has a bank account. It pays from the balance in the customer’s bank account.

TYPES OF CHEQUE

The Cheques are of various types and the most common of them are

1. ELECTRONIC CHEQUE – The electronic image form of the cheque is called ‘Electronic Cheque’. It is written and signed in a secure system using a digital signature.

2. TRUNCATED CHEQUE – The cheque which is the paper form is called a ‘Truncated cheque’. It has a physical structure and can be moved from one person to another by hand.

Every bank has its own cheque forms printed and is given to the customers after the opening of the account with the bank. These Cheque forms are printed on special security papers to protect the customers from fraud.

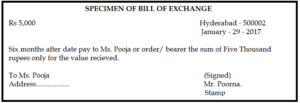

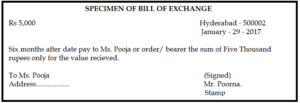

BILL OF EXCHANGE

A Bill of Exchange is one of the Negotiable Instruments and It has certain features as It must be in writing form, It must contain an order to pay and not a promise or request. The Bill of Exchange document must be unconditional in nature. The document of the Bill of Exchange must be signed by the drawer and it must contain a specified date on which the payment should be made to the payee by the drawer.

PARTIES OF BILL OF EXCHANGE

⦿ Drawer – The person to whom the amount of bill is payable.

⦿ Drawee – The person who is responsible for acceptance and payment of the bill.

⦿ Payee – The person to whom the bill is payable.

KINDS OF BILLS OF EXCHANGE

Bills of Exchange are of different types based on their functionality and nature. Some of them are as follows:

⦿ Inland Bills

⦿ Foreign Bills

⦿ Trade and Accommodation Bills

⦿ Time Bills

⦿ Demand Bills

⦿ Documentary Bills

Acceptance of a Bill shows the acceptance and responsibility of the drawee to pay the money to the drawer of the bill. The Bill of Exchange must be presented for acceptance before the maturity of the bill. When a period of maturity is specified in the document, it must be presented within that period.

Difference Between Cheque and Bill of Exchange

| CHEQUE | BILL OF EXCHANGE |

|---|---|

| The Cheque is the document which contains an order to the bank to pay a certain amount of money from the account of the customer. | The Bill of Exchange is the document which contains an order to drawee to pay a certain amount to the payee on demand or after certain time period. |

| Defined In | |

| The cheque is defined in section 6 of the Negotiable Instruments Act, 1881. | Bill of Exchange is defined in Section 5 of the Negotiable Instruments Act, 1881. |

| Obligation to Pay | |

| The amount which is mentioned in the cheque is always payable on demand. | The amount which is mentioned in the bill of exchange may be payable on demand or after a certain time period. |

| Days of Grace | |

| The cheque is not allowed to have any days of grace after the cheque is presented for payment to the bank. | The Bill of Exchange is allowed to have three days of grace period for payment. |

| Acceptance | |

| The Cheque does not need any acceptance from the parties before it is presented for payment. | The Bill of Exchange needs acceptance from the drawee to pay the amount. |

| Crossing Of document | |

| The cheques can be crossed to ensure the safety against theft or loss of cheques. | There is no such feature as the crossing of Bill of Exchange. |

| Dishonour | |

| Notice of dishonor is not necessary in the case of dishonor. | Notice of dishonor is necessary in the case of dishonor. |

| Liability | |

| The parties remain liable to pay even notice of dishonor is not given. | The parties who does not receive a notice of dishonor can escape the liability to pay. |

| Validity | |

| The cheque is only valid for three months from the date it is issued. | There is no such thing as validity in the case of a bill of exchange. |

| Stamp | |

| The cheque is not required to duly stamped by the authority. | The Bill of Exchange must be duly stamped as per Indian Stamp Act. |

Similarities

- They are Negotiable Instrument.

- Addressing the drawee to make payment.

- Always in writing.

- Signed by the drawer of the instrument.

- Express order to pay a certain amount.

Conclusion

Cheque and Bill of Exchange both the instruments contain an unconditional order to pay a certain sum of money to the person whose name is mentioned in the document. In the case of Bill of Exchange drawer and payee may be the same person in some cases. In the case of a Cheque, the Drawer and the Payee are always different.