The word Negotiable means transferable from one person to another either by delivery or by endorsement and delivery. A Negotiable instrument is a written document where rights are created in favor of one party and obligations are made on the another party. The Negotiable instruments are of three types, They are:

⦿ Promissory Note

⦿ Bill of Exchange

⦿ Cheques.

In this article, we learn about Promissory notes and Bills of Exchange and the conditions which make them different from each other.

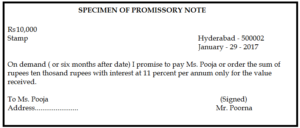

PROMISSORY NOTE

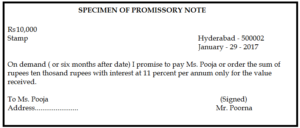

A ‘Promissory Note’ is defined as a document in writing which contains an unconditional promise, signed by the maker to pay a certain sum of money to, or to the order of, a certain person or to the bearer of the instrument.

Parties of Promissory Note

⦿ Maker – The person who makes the note and promises to pay the amount stated to the payee.

⦿ Payee- The person to whom the amount which is mentioned in the note is payable.

Features of Promissory Note

There are certain conditions which are essential for a document to be called as Promissory Note, They are as follows

⦿ A promissory note must be in the form of writing.

⦿ It must contain an undertaking by the maker or promise to pay.

⦿ The promise to pay by the maker to the payee is needed.

⦿ The promissory note which is created must be signed by the maker of the promissory note, otherwise, it is not valid.

⦿ The instrument must state the maker and the payee of the promissory note.

⦿ The sum payable by the maker to the payee should be stated in certain.

⦿ The instrument must contain a promise to pay the amount in terms of money only.

⦿ The amount stated in the instrument may be payable on demand by the payee or after a definite period.

⦿ The document must be duly stamped under the Indian Stamp Act.

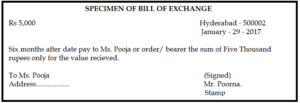

BILL OF EXCHANGE

A ‘Bill of Exchange’ is defined as a negotiable instrument in writing, containing an unconditional order, signed by the maker of the document, directing a certain person

to pay a certain sum of money only to or to the order of, a certain person, or to the bearer of the instrument.

Parties of Bill Of Exchange

⦿ Drawer – The person to whom the amount of bill is payable.

⦿ Drawee – The person who is responsible acceptance and payment of the bill.

⦿ Payee – The person to whom the bill is payable.

Features of Bill Of Exchange

⦿ The document must in the form of writing.

⦿ The Bill of Exchange contains an order to pay, not a promise or request.

⦿ The order to pay which is stated in the document must be unconditional.

⦿ There must be three parties i.e., Drawer, Drawee, and payee. Sometimes one person may take up the role of two parties.

⦿ The Document must be signed by the drawer.

⦿ The Sum of money stated in the document must be certain or capable of being made certain.

⦿ The order to pay amount must be in the form of money only.

⦿ The document must be duly stamped as per the Indian Stamp Act.

COMPARISON TABLE

| PROMISSORY NOTE | BILL OF EXCHANGE |

|---|---|

| The promissory note consists of two parties- The Maker (debtor) and the Payee (creditor) | The Bill of Exchange document consists of three parties- The Drawer, the Drawee, the Payee. Sometimes the drawer and payee may be the same person. |

| Consists of | |

| The Promissory Note contains an "Unconditional Promise" by the Maker of the note to pay the Payee the amount mentioned. | The Bill of Exchange contains an "Unconditional Order" to the Drawee to pay the amount to the Drawer as per conditions mentioned by the Drawer. |

| Defined In | |

| Promissory Note is defined in Section 4 of the Negotiable Instrument Act, 1881. | Bill of Exchange is defined in Section 5 of the Negotiable Instrument Act, 1881. |

| Acceptance | |

| The Promissory Note does not require any acceptance from the parties concerned before it is presented for payment. | The bills payable which are stated in the Bill of Exchange must be accepted by the drawee or his agent before it is presented for payment. |

| Liability | |

| The liability of the Maker of the Promissory Note is Primary and absolute upon non-payment of the amount. | The liability of the Maker of the Bill of Exchange is Secondary and Conditional upon non-payment by the drawee. |

| Dishonour | |

| In the case of dishonor, no 'Notice of Dishonour' is required to give the Maker of the Promissory Note. | In the case of dishonor. Notice of Dishonour must be given by the holder to the drawer and also to all the parties involved. |

| Relationship | |

| The maker of the Promissory Note will have a direct relation with the payee. | The maker or drawer of the Bill of Exchange does not have immediate relation with the acceptor or drawee of the document. |

CONCLUSION

Promissory Note and Bill of Exchange have one thing in common, These two documents show an agreement for one party to pay a definite sum of money to a second party. The above article explains the main idea of the ‘Promissory Note’ and ‘Bill of Exchange’ and there are many differences and similarities which are there between these two types of Negotiable Instruments.