The main difference between Single entry system and double entry system is based on the completeness of the book-keeping method. the single-entry system is an incomplete and unscientific system, whereas the Double entry system is a perfectly complete, and scientific system of book-keeping.

This article mainly concentrates on communicating the differences between single entry and double entry systems of book-keeping.

Single Entry System

Kohler defined Single entry system as, “Single entry system is a system of bookkeeping in which as the rules, only records of cash and personal accounts are maintained. It is always an incomplete double entry varying with circumstances.

The single entry system is an incomplete system of recording transactions because it records only one aspect of the transaction i.e, it only records cash book and personal accounts of debtors & creditors of the business. It only records the accounts of suppliers, creditors, and cash accounts.

It is considered as unsuitable for big businesses and is only suitable for small business firms and partnership firms. This system does not have any rules and principles to follow and the system of recording varies from business to business.

The single entry system of recording is very simple, easy to understand, and an effortless way of recording of business transactions. The main drawback of this method is that the profit calculation is only an estimate and cannot be accurate.

Types of Single Entry System

Based on the style and information available, recording of transactions in single-entry system can be classified into 3 types,

- Pure Single Entry – There is no information on business transactions at all, not viable in the practical world.

- Simple Single Entry – Only personal and cash accounts transactions are taken into consideration and record in the books of accounting.

- Quasi Single Entry – Along with personal and cash accounts, subsidiary accounts like sales accounts, purchases accounts are also recorded.

Double Entry System

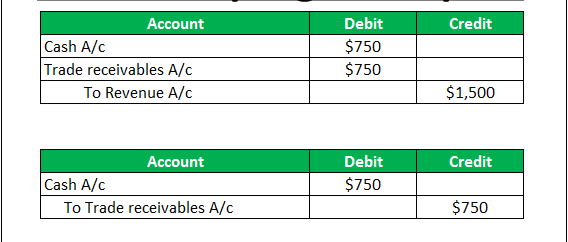

The double-entry system of book-keeping is considered as a scientific method of book-keeping. It records two aspects namely giving aspect and relieving aspect of the business transactions. It is regarded as a complete system of recording.

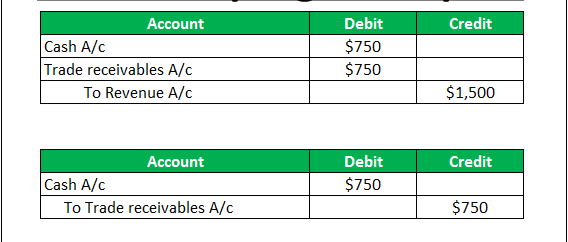

The basic principle on which the double-entry system is based on is “For every debit, there must be an equal and corresponding credit”. This system maintains records of personal, real, and nominal accounts. This system of book-keeping is widely used by large business firms.

It helps in ascertaining the performance of the business firm. It provides information about the financial position of the firm to the management for decision-making purposes. The accounts prepared using this system is accepted by the tax authorities and can be able to detect fraud easily.

Differences Table (Single Entry System vs Double Entry Sysytem)

| SINGLE ENTRY SYSTEM | DOUBLE ENTRY SYSTEM |

|---|---|

| Single entry system is an incomplete and unscientific system of book-keeping. | Double entry system is a perfect, complete and scientific system of book-keeping. |

| Transactions Recorded | |

| It only records single aspect (debit or credit) of the transaction. | It records both the debit and credit aspects of the transaction. |

| Accounts Maintained | |

| It maintains personal accounts of debtors, creditors and a cash book for the recording of transactions. | It maintains personal, real and nominal accounts for the recording of transactions. |

| Used by | |

| Single entry system is mainly used by small business firms and partnership firms. | The Double entry system is can be used by both small and big business firms for recording the transactions. |

| Special skills | |

| There is no need for specialized knowledge to maintain books in single entry system. | The person who is responsible for book-keeping in double entry system should possess specialized knowledge and skills. |

| Trail Balance | |

| In this system, Trail Balance cannot be prepared because of incomplete record of transactions. | Trail Balance can be prepared by using debit and credit aspects of the recorded transactions. |

| Final Accounts | |

| Preparation of trading and profit & loss accounts for knowing the financial position of the firm is not possible. | Trading and Profit & Loss accounts are prepared to ascertain the financial position of the firm. |

| Detection of Errors | |

| Detection of errors in the books prepared by single entry system is very tough. | Detection of errors can be easily done in double entry system. |

| Nature of Cost | |

| Single entry method of book-keeping is less costly and is considered as the simple way of recording transactions. | Double entry method of book-keeping is costly and complex work is involved in the recording of transactions. |

Conclusion

From the above discussion, it is clear that single entry system is incomplete and double entry system is complete and scientific in nature. Besides all these, there is a chance of fraud in every business and it is true that Double entry system can help to eliminate fraudulent practices in maintaining accounts, whereas Single entry system does not provide any security from fraudulent accounting practices.

Recommended Reading

Don’t limit your knowledge on types of booking-keeping systems, read further about how the transactions are recorded in the Double-Entry System (Differences between Journal and Ledger transactions)